Table of Contents

With the number of excellent cryptocurrency exchanges available these days, traders looking for the right fit may wonder what sets them apart from the others. In this guide, we’ve compiled a review of the best crypto exchanges, including what they offer, how they work, and who they’re oriented to.

What to Look for in a Crypto Exchange

Crypto exchanges are platforms where you can buy, sell, and trade digital assets built on blockchain technology.

For the most part, your pick is a personal decision, but there are some basic criteria that matter:

- Supported assets and markets: How many cryptocurrencies does it list? Does it support fiat? Which trading features can you find here? Is it available worldwide?

- Security and regulations: Is the crypto exchange secure? Has it fallen victim to any hacks? Is it regulated? Do they offer Proof of Reserves?

- Most notable features: What is it best known for?

- Who it’s best for: Does this exchange work for most experience levels, or will you lose out if you pick it?

Top Cryptocurrency Exchanges

Finding the best crypto exchange can be challenging. We’ve assembled a list of the five most widely used exchanges currently available, with a short review of each, to simplify your search.

OKX

OKX is a global cryptocurrency exchange offering both centralized and decentralized trading, advanced financial services, and a wide array of trading services.

Key Features

OKX offers many trading options, including spot, margin, expiry, options, perpetual futures, and DeFi opportunities and lending. You can also look at the Cardano price today directly on the platform, as well as for hundreds of other coins and tokens.

Aside from its centralized crypto exchange, OKX offers a Web3 wallet that serves as an entry point for DeFi. It supports 100+ chains and lets you store, swap, and stake your assets, all with analytical and discovery tools.

Supported Assets & Markets

- OKX has over 350 listed cryptocurrencies, with many of them trading against each other or against stablecoins such as USDT.

- The platform has a fiat converter that supports a wide range of different fiat currencies from around the world.

- It supports spot, futures, and options trading.

Security & Regulations

OKX maintains a reserve of all account assets, allowing users to self-verify its Proof of Reserves. It also runs a Anti-Money Laundering, Anti-Terrorist Financing, and Trade & Economic Sanctions Program to make sure it’s complying with regulations.

Who It’s Best For

OKX is a great choice for experienced and advanced traders who can take advantage of the tons of options available. It’s also suited for beginners and newcomers who want to learn more in a rich, intuitive environment without becoming overwhelmed.

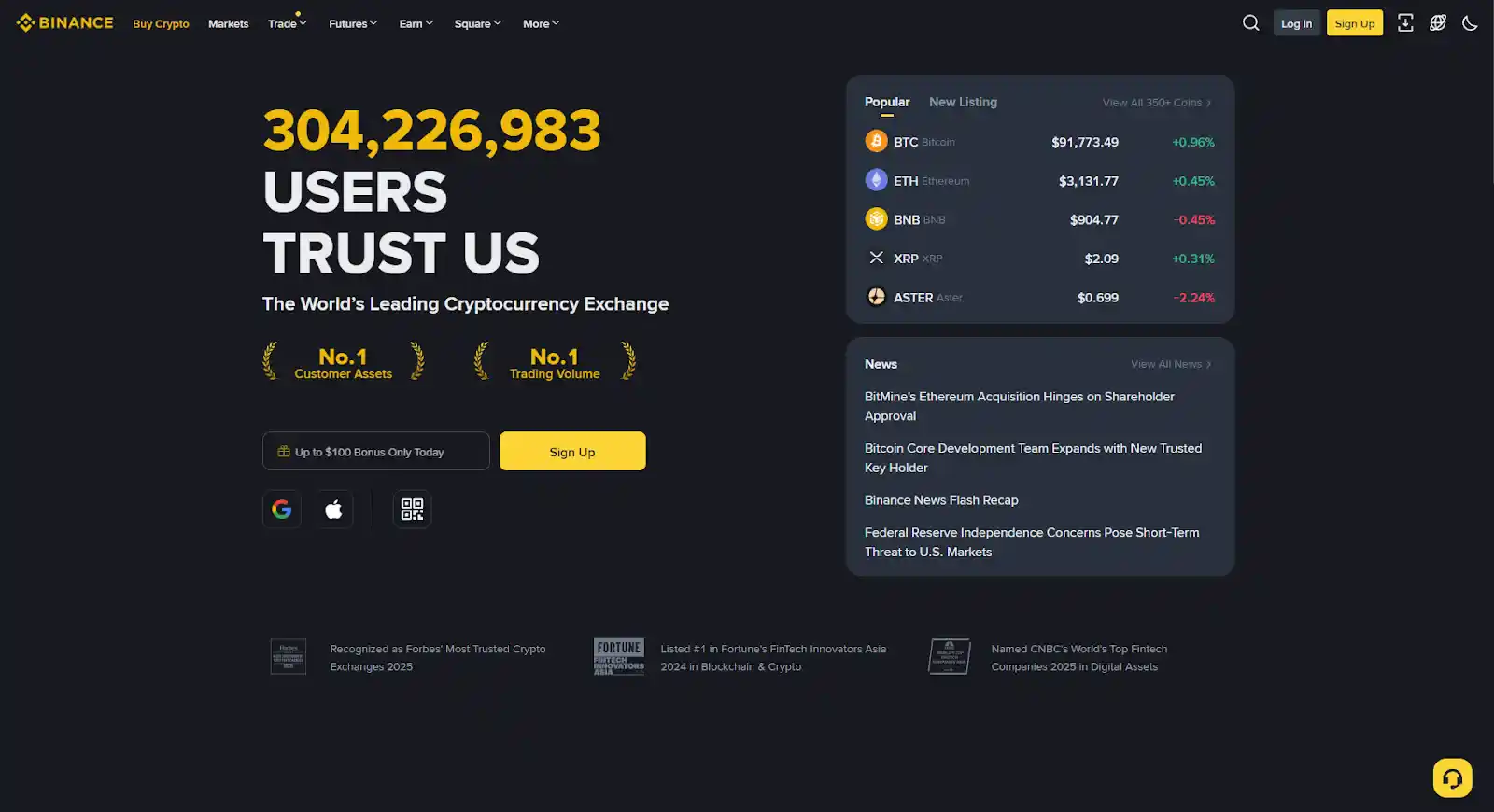

Binance

Binance is another major cryptocurrency exchange that offers both centralized and decentralized trading, various trading options, and support for many cryptocurrencies.

Key Features

Binance offers spot, futures, margin, and P2P trading, plus easy access to newly launched coins under its Alpha tab, and more. There’s also decentralized trading available through its Web3 wallet, plus an NFT launchpad and many advanced tools.

Supported Assets & Markets

- Binance has more than 400 listed cryptocurrencies and thousands of markets, where you can trade different assets against each other.

- Enables deposits and withdrawals in 20+ fiat currencies.

- Supports both spot and future markets, and margin trading and options.

Security & Regulations

Binance has a Proof of Reserves that lets you verify that all the account balances are backed 1:1. The platform is committed to working with regulators wherever it operates, and it currently holds a number of licenses and registrations worldwide.

Who It’s Best For

It’s good for active traders and investors who can take advantage of its features, but also those who don’t mind its relatively complex interface and tool suite.

Coinbase

Coinbase is a major crypto exchange that’s especially aimed at beginners, with a wide selection of trading tools and features made relatively simple. Aside from the general offering, there’s a more advanced version of the exchange and a paid version targeting professional traders.

Key Features

Coinbase offers different services for individuals, businesses, and institutions based on their specific needs. Mainly, however, you’ll be able to find different types of trades here, spot and futures trading, plus a credit or debit card funded by crypto.

Supported Assets & Markets:

- Coinbase supports trading of more than 350 different crypto assets on its exchange, and tracks thousands of cryptos, from the biggest coins to the very recently launched ones.

- It has a fiat onramp that supports more than 60 fiat currencies.

- Offers both spot and futures markets, with futures available on the more advanced version of the exchange.

Security & Regulations

As a publicly listed company, Coinbase publishes audited financial disclosures and provides transparency reports on asset custody. The exchange also works with regulatory bodies wherever it operates to ensure compliance and obtain the licenses required to operate.

Who It’s Best For

Coinbase is a good choice for complete beginners to crypto who appreciate the simplicity, ease of use, and a complete separation between the simple and advanced trading views.

Kraken

Kraken is a long-standing crypto exchange that offers a range of trading options, staking, and analytics on one platform. It also offers a VIP version for ultra-high-net-worth individuals.

Key Features

Kraken offers spot and futures trading, all the advanced trading features you may need within Pro, plus the ability to create your own trading layout based on the data fields and features you need. Kraken Desktop lets you trade from a desktop-based interface, whereas the Inky feature gamifies the trading process.

Supported Assets & Markets

- Kraken currently lists 550+ tradable crypto assets, regularly adding more.

- It offers relatively limited fiat funding options, covering only USD, CAD, EUR, GBP, CHF, and AUD.

- You can trade both spot and futures markets, as well as options and margin trading, on Kraken Pro.

Security & Regulations

Kraken clients can verify their holdings with its Proof of Reserves tool, and detailed instructions are available on the website. The platform strives to comply with the regulations wherever it operates, and holds a number of licenses and registrations from different territories.

Who It’s Best For

Kraken is more aimed at intermediate to advanced traders who know their way around a crypto exchange and trading platform. It’s also well-suited for businesses and institutions.

Bybit

Bybit is a global crypto exchange that focuses on advanced features, including different trading tools and approaches, trading automation, and more.

Key Features

Bybit offers spot, futures, and options trading, along with margin that go up to 100x for advanced traders. Additionally, it provides staking, lending, an integrated wallet, and NFT marketplace options.

Supported Assets & Markets

- Bybit has a few hundred cryptocurrencies listed, though the exact number of tradable assets is unclear.

- It supports a wide range of global fiat currencies for deposits and withdrawals.

- Offers both spot and futures markets, plus margin trading opportunities, options, and some TradFi opportunities.

Security & Regulations

Bybit offers a Proof of Reserves on its website, where you can check your own account, the Bybit Reserve Ratio, or the data from its audit. The exchange operates under regulatory frameworks in select jurisdictions, with restrictions in several countries.

Who It’s Best For

Bybit is more geared toward advanced traders, high-net-worth individuals, and those who can take advantage of its high-margin capabilities and other high-risk trades.

What is the Best Cryptocurrency Exchange?

As crypto markets mature, transparency and security standards matter just as much as fees and features.

Looking at how exchanges handle reserves, regulatory compliance, and user protections gives you a clearer picture of what’s happening behind the interface. Having said that, availability, features, and regulatory status vary by jurisdiction and are subject to local laws and platform policies.

A well-informed choice starts with understanding how your assets are actually managed once they’re on the platform.