Table of Contents

Is Financial Technology the Future of Global Finance?

“Financial technology is not only an industry—it is the foundation of today’s financial services.” – Chris Skinner, Fintech Expert

In a world controlled by digital revolution, Financial Tech Companies are changing the face of the global financial world. Be it digital banking or blockchain technologies, these firms are creating new standards in terms of efficiency, security, and customer satisfaction.

As we enter 2025, the financial tech companies is experiencing unprecedented expansion, fueled by innovation and rising consumer demand. But who are the firms at the forefront of this revolution? Let’s have a look at the top 10 financial tech companies to watch out for in 2025.

Selection Criteria for Top Financial Tech Companies

Picking the most promising financial tech companies is no mean feat. These companies were picked on the following factors:

- Innovation & Technology: Utilization of AI, blockchain, and machine learning.

- Market Impact: Role in bringing about financial inclusion and world financial stability.

- Customer Base & Reach: User base and presence globally.

- Revenue & Growth: Market capitalization and financials.

- Regulatory Compliance & Security: Adherence to financial laws and cybersecurity features.

- Sustainability & Ethics: Green fintech and ethical financial solutions.

Top 30 Global Financial Tech Companies

1. Checkout.com

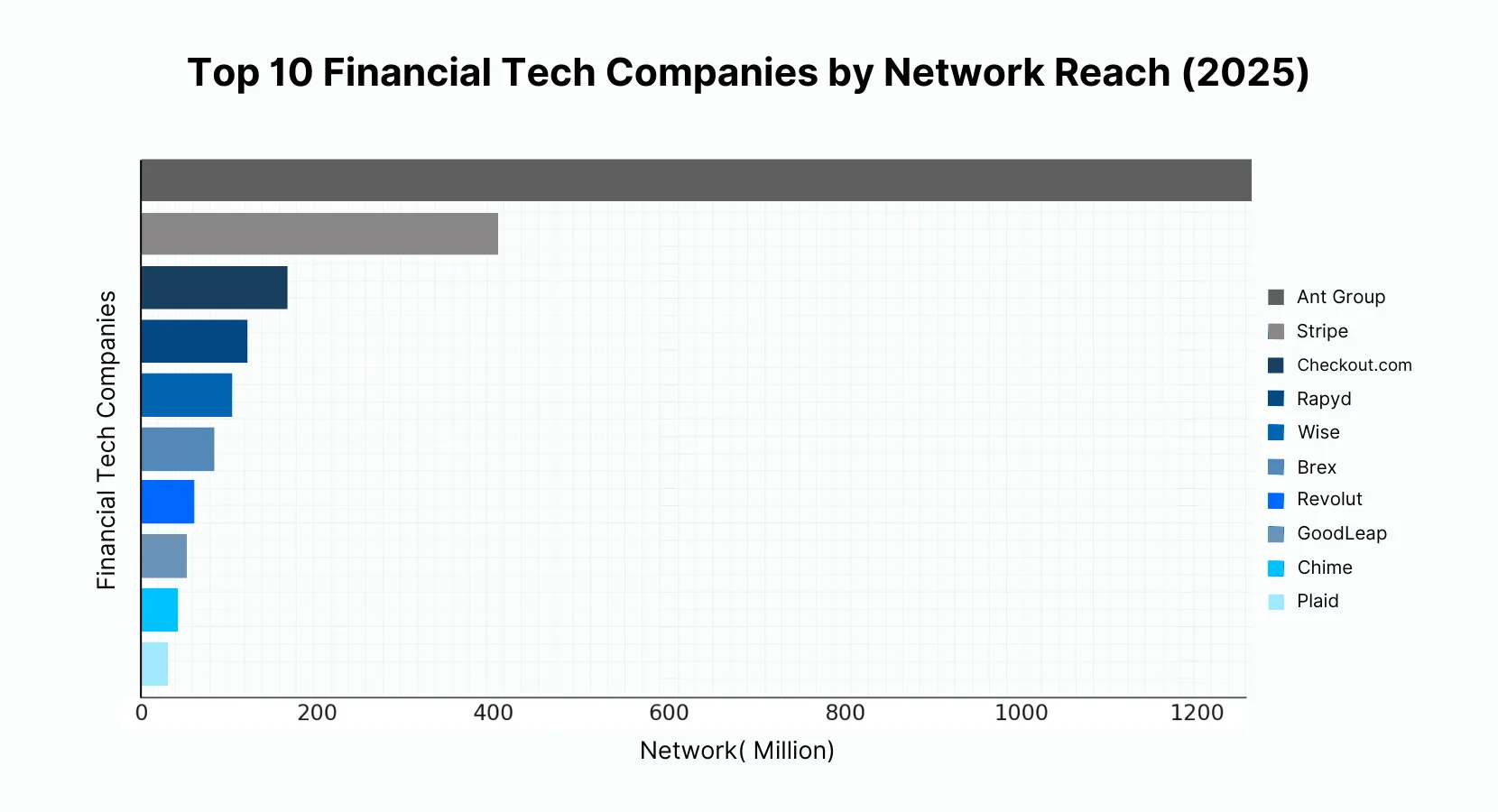

- Network: Operates in 150+ countries

- Achievements: A pioneer in online payment processing, assisting companies with smooth transactions in multiple currencies and platforms.

- Growth: Diversified into new markets, substantially growing transaction volume in 2025.

Checkout.com has evolved in a short time into one of the most reliable names in digital payments online. With strong security, fraud protection, and easy integration for merchants, it continues to redefine global online transactions.

2. Wise

- Network: Serves millions of customers in 80+ countries

- Achievements: Renowned for its low-cost and transparent cross-border money transfers.

- Growth: Added increased business usage and launched new multi-currency banking services.

Wise (previously TransferWise) is an international payments disruptor. With its low fees and real exchange rate model, it has earned the confidence of individuals and businesses looking for affordable financial services.

3. GoodLeap

- Network: Partnered with 20,000+ sustainable businesses

- Achievements: Fintech leader in sustainable home improvement financing.

- Growth: Expanded eco-friendly financing solutions to new markets.

GoodLeap has made significant strides in financing energy-efficient home solutions, ensuring that more homeowners have access to cost-effective sustainability projects.

4. Brex

- Network: Serves thousands of startups and enterprises

- Achievements: Transformed corporate credit products, providing immediate approvals and expense management capabilities.

- Growth: Diversified partnerships and introduced new features for international companies.

Brex remains a go-to option for startups and SMBs seeking nimble corporate spend solutions. Its intuitive integrations and AI-powered expense management elevate it to industry leadership.

5. Plaid

- Network: Connects with 12,000+ financial institutions

- Achievements: Pioneered open banking API technology.

- Growth: Enhanced security measures and strengthened global partnerships.

Plaid is at the forefront of fintech infrastructure, allowing startups and financial institutions to build user-friendly, data-driven solutions.

6. Rapyd

- Network: Provides global payment services in 100+ countries

- Achievements: Global leading cross-border payments provider for commerce.

- Growth: Mass-scale operations in emerging international markets and improved domestic payment systems.

Rapyd facilitates cross-border payments by offering enterprises end-to-end payment networks and financial technology services that enable diverse payment options globally.

7. Chime

- Network: Over 15 million users in the U.S.

- Achievements: Top online bank offering feeless banking services.

- Growth: Increased lending services and launched AI-driven financial tools.

Chime has revolutionized contemporary banking by abolishing fees and providing friendly digital banking solutions. With its financial wellness emphasis, it keeps on drawing millions of new users.

8. Revolut

- Network: 40M+ users, operating in 35+ countries

- Achievements: Released decentralized finance (DeFi) features, Artificial Intelligence (AI)-driven banking solutions.

- Growth: Launched commission-free world stock trading and crypto trading services.

As one of the most disruptive neobanks around, Revolut provides a seamless digital banking experience with multi-currency capabilities, stock trading, and cryptocurrency management.

9. Stripe

- Network: 50+ countries, 3M+ businesses

- Achievements: Dominant in online payments, diversified into embedded finance and crypto payments.

- Growth: Revenue over $15B in 2025, increased partnerships with big businesses and small businesses across the world.

Stripe has established itself as a worldwide leader in payment processing, providing companies with a simple-to-integrate platform that simplifies online transactions.

10. Ant Group

- Network: 1.3B users worldwide

- Achievements: First AI-based credit services, biggest digital payment platform in China.

- Growth: Processed more than $18T in payments in 2025 and rolled out blockchain-supported payment cross-border solutions.

Ant Group, which is owned by Alibaba, has become Fa central component of China’s financial system, using AI and blockchain to improve credit availability and cross-border payments.

11.Adyen

- Network: Operates globally, serving businesses across multiple continents.

- Achievements: Provides end-to-end payment capabilities, data-driven insights, and financial products in a single solution.

- Growth: Expanded its services to support businesses in achieving their ambitions faster.

12. Xero

- Network: Serves small businesses worldwide with a significant presence in multiple countries.

- Achievements: Offers a global small business platform that includes core accounting solutions, payroll, workforce management, expenses, and projects.

- Growth: Expanded its ecosystem with connected apps and integrations with banks and financial institutions. Startups can save on their subscription with a Xero discount code.

13. MassMutual

- Network: Primarily operates in the United States with a substantial customer base.

- Achievements: A longstanding financial services company offering insurance and investment solutions.

- Growth: Continued commitment to helping people protect their families and support their communities.

14. Riskified

- Network: Collaborates with major global brands across various industries.

- Achievements: Empowers businesses to enhance e-commerce growth by outsmarting fraud and risk.

- Growth: Developed an AI-powered fraud and risk intelligence platform analyzing individual interactions.

14. Affirm

- Network: Partners with numerous merchants across the United States.

- Achievements: Provides point-of-sale installment loans to consumers, offering transparent and flexible payment options.

- Growth: Expanded merchant partnerships and consumer adoption of its financing solutions.

15. Klarna

- Network: Operates in multiple countries, serving millions of consumers and retailers.

- Achievements: Offers buy-now-pay-later services, revolutionizing the shopping experience with flexible payment options.

- Growth: Expanded its services and market reach, becoming a leading global payments provider.

16. Robinhood

- Network: Serves millions of users across the United States.

- Achievements: Democratized finance by offering commission-free trading of stocks, ETFs, and cryptocurrencies.

- Growth: Continued to expand its user base and financial product offerings.

17. Coinbase

- Network: Operates in over 100 countries with millions of users.

- Achievements: Provides a secure platform for buying, selling, and managing cryptocurrencies.

- Growth: Expanded its cryptocurrency offerings and services, becoming a leading crypto exchange.

18. PayPal

- Network: Operates globally, serving over 400 million active accounts.

- Achievements: Provides a platform for digital payments and money transfers.

- Growth: Expanded its services to include cryptocurrency transactions and buy-now-pay-later options.

19. Square (Block, Inc.)

- Network: Serves millions of businesses and individuals worldwide.

- Achievements: Offers payment processing solutions and has expanded into banking and cryptocurrency services.

- Growth: Continued innovation in financial services, including the development of Cash App and Square Banking.

20. SoFi

- Network: Provides financial services to over 4 million members in the U.S.

- Achievements: Offers a range of financial products, including loans, investment services, and banking.

- Growth: Expanded its product offerings and went public, increasing its market presence.

21. Nium

- Network: Serves 190+ markets with real-time cross-border payments.

- Achievements: Recognized among the top fintech companies of 2024 by CNBC.

- Growth: Raised $50 million (Series E) to fuel expansion.

22. nCino

- Network: Partners with major banks and financial institutions globally.

- Achievements: Cloud banking platform revolutionizing traditional banking processes.

- Growth: Launched AI-powered Banking Advisor; continues expanding its fintech solutions.

23. Monzo

- Network: 7 million+ users, primarily in the UK.

- Achievements: Digital-only bank with budgeting and savings tools.

- Growth: Expanding into the U.S. and business banking.

24. N26

- Network: 8+ million customers in Europe and the U.S.

- Achievements: Mobile-first banking platform with no hidden fees.

- Growth: Expanding crypto and investment services.

25.Bolt

- Network: Used by major e-commerce retailers.

- Achievements: Pioneering one-click checkout for online stores.

- Growth: Expanding AI-driven fraud detection.

26. WeLab

- Network: Serves 50+ million users in Asia.

- Achievements: Digital banking and lending platform in Hong Kong.

- Growth: Expanding AI-driven lending solutions.

27. Airwallex

- Network: 100+ countries, serving SMBs and enterprises.

- Achievements: Specializes in cross-border payments and FX.

- Growth: Rapid expansion across the U.S. and Europe.

28. Creditas

- Network: Leading lending fintech in Latin America.

- Achievements: Provides secured loans for cars, homes, and salaries.

- Growth: Expanding into insurance and investment services.

29. Upstart

- Network: Partners with banks and credit unions in the U.S.

- Achievements: AI-driven lending platform reducing loan approval time.

- Growth: Expanding into auto and mortgage lending.

30. FIS Global

- Growth: Investing heavily in AI and blockchain-based solutions.

- Network: Supports banks and merchants worldwide.

- Achievements: Offers financial infrastructure solutions, including payment processing.

Future of Financial Tech Companies: Predictions for 2030

- AI-Driven Personalized Financial Services:

AI will reign supreme over the financial technology sector, enabling hyper-personalized banking and investment experiences. - Increased Blockchain Adoption:

Banks will embrace blockchain for quicker, more secure transactions and smart contracts. - Expansion of Digital-Only Banks:

Neobanks will grow even more, providing entirely digital banking services without branch access. - Financial Inclusion in Emerging Markets:

Fintech will be instrumental in offering banking services to the unbanked masses globally. - Cybersecurity Innovations:

Financial tech companies will pour significant money into security tools such as quantum encryption and biometrics as cyber attacks rise.

Conclusion

The financial tech companies is transforming at a record rate with these top 10 players at the forefront. Through payments innovation, blockchain, open banking, and AI-based financial services, they are redefining how consumers and merchants engage with money. With technology getting better, fintech players will keep spearheading financial inclusion, enhancing the efficiency of transactions and unlocking new investment opportunities.

Looking ahead to 2030, fintech will become increasingly integrated into everyday financial life, with personalization through AI, decentralized finance, and improved cybersecurity leading the way. Conventional banking models could continue to be upended, with fintech products and services providing simpler, cheaper, and more efficient substitutes. The future of finance is technological, and these firms are leading the charge.

FAQs

1. What is a financial Tech Companies?

A financial tech company leverages technology to improve and automate financial services, including banking, payments, investments, and lending.

2. Why are financial Tech Companies important?

They provide innovative solutions that enhance financial accessibility, security, and efficiency in a digital-first world.

3. Which financial Tech Companies are leading in 2025?

Companies like Stripe, PayPal, Revolut, and Coinbase are among the top leaders in the fintech industry.

4. How is AI impacting financial Tech Companies?

AI is revolutionizing fintech by enabling automated financial advice, fraud detection, and personalized banking experiences.

5. What is the future of financial tech companies?

By 2030, financial tech companies will be at the forefront of digital banking, blockchain solutions, and AI-driven financial services.