Table of Contents

FinTech, short for Financial Technology, refers to the integration of technology into offerings by financial services companies to improve their use and delivery to consumers. FinTech solutions streamline financial transactions, increase transparency, and provide innovative tools for managing finances, fundamentally transforming how businesses and consumers interact with financial services.

FinTech encompasses a broad spectrum of applications, including digital payments, online banking, investment management, personal finance management, and more. By leveraging cutting-edge technologies like artificial intelligence, blockchain, and big data analytics, FinTech aims to enhance the efficiency and accessibility of financial services. This sector has grown exponentially, driving significant changes in traditional financial systems and paving the way for a more inclusive and convenient financial ecosystem.

FinTech Market Growth in 2024

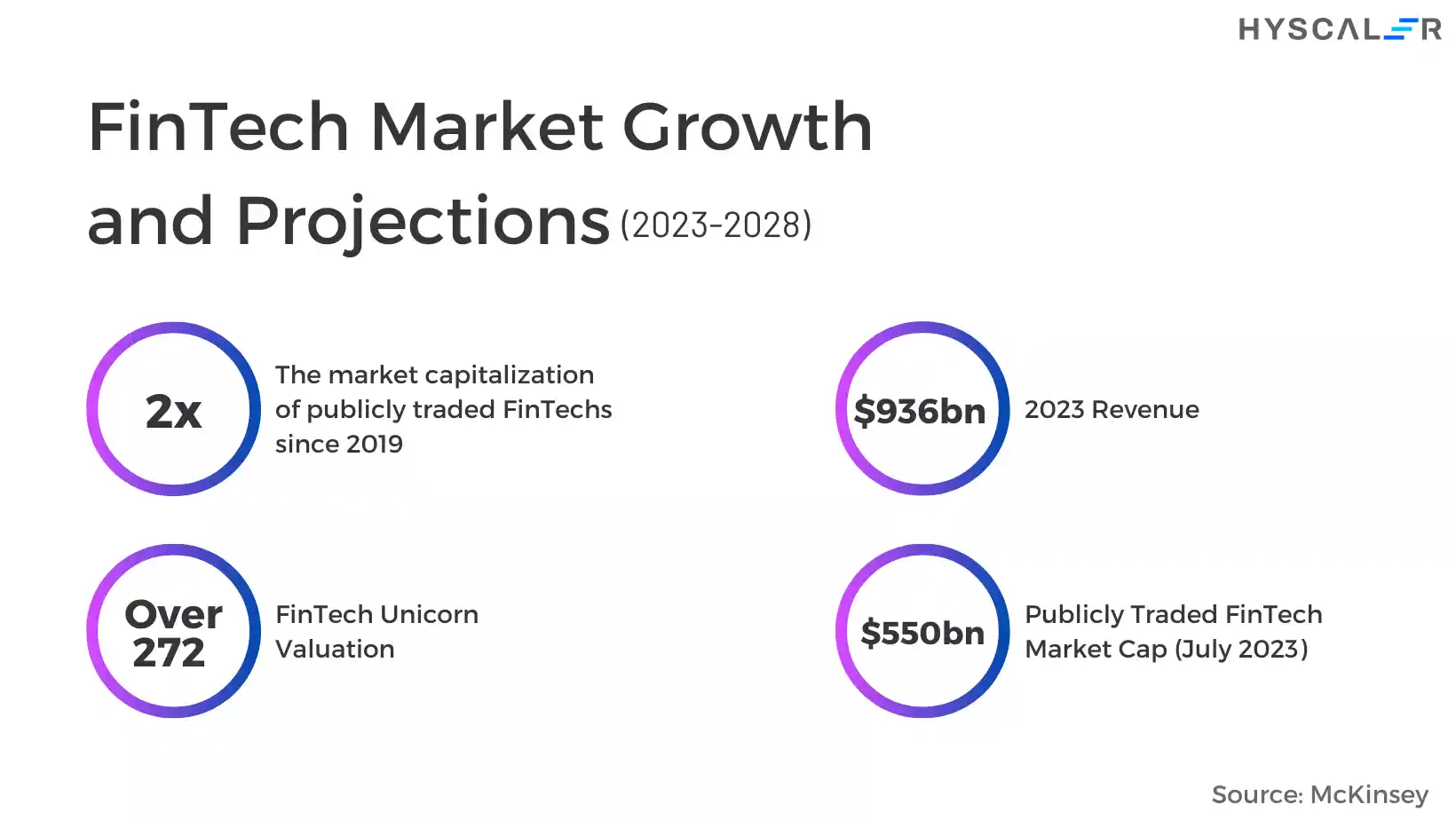

The FinTech market is experiencing significant growth, with revenue projections indicating a near threefold increase between 2023 and 2028. According to McKinsey’s research, revenue in the fintech sector was valued at $936 billion in 2023. The sector has become integral to how consumers and businesses engage with financial services, fostering an environment ripe for innovation and efficiency.

As of July 2023, publicly traded fintechs represented a market capitalization of $550 billion, doubling since 2019. Additionally, there are over 272 fintech unicorns with a combined valuation of $936 billion, a substantial increase from five years ago. Despite a market correction in 2022 that slowed growth, the fintech industry continues to innovate and adapt, positioning itself for sustained value creation in a challenging economic landscape.

The growth in the fintech market can be attributed to several factors, including increased internet penetration, the proliferation of smartphones, and a growing preference for digital financial services among consumers. As financial institutions and startups continue to embrace digital transformation, the demand for innovative fintech solutions is expected to rise, further driving the market’s expansion.

Trends in the FinTech Market

Banking Mobility: The shift from traditional banking to smartphone apps has accelerated, driven by the need for digital solutions during the pandemic. Consumers now expect seamless, 24/7 access to banking services from their mobile devices.

Artificial Intelligence: AI is pivotal in enhancing FinTech applications through automated financial data analytics, chatbots, and personalized dashboards. AI interfaces improve customer service and offer tailored financial solutions.

Crypto and Blockchain: The exploration of blockchain technology continues, offering efficient regulation and management of digital assets. Blockchain’s transparency and security features are revolutionizing financial transactions and asset management.

Market Democratization: FinTech is making financial services more accessible to a broader audience, from businesses to individual investors. The democratization of financial tools empowers more people to manage their finances effectively.

Products for Self-Employed: FinTech provides tools for freelancers and self-employed individuals to manage taxes, invoices, and financial stability. Many of these applications now include features like free tax filing, making it easier and more affordable for gig workers to stay compliant during tax season. Ultimately, these applications support the growing gig economy by offering specialized financial solutions.

Benefits of FinTech Software Development for Businesses

Banking Mobility: The shift from traditional banking to smartphone apps has accelerated, driven by the need for digital solutions during the pandemic. Consumers now expect seamless, 24/7 access to banking services from their mobile devices. Mobile banking apps have become essential tools for managing finances, offering features such as balance checks, fund transfers, bill payments, and more.

Artificial Intelligence: AI is pivotal in enhancing FinTech applications through automated financial data analytics, chatbots, and personalized dashboards. AI interfaces improve customer service and offer tailored financial solutions. Machine learning algorithms can analyze vast amounts of data to detect patterns, predict trends, and make recommendations, significantly improving decision-making processes in the financial sector.

Crypto and Blockchain: The exploration of blockchain technology continues, offering efficient regulation and management of digital assets. Blockchain’s transparency and security features are revolutionizing financial transactions and asset management. Cryptocurrencies and blockchain-based solutions provide a decentralized approach to financial services, reducing the reliance on traditional banking systems and enabling faster, more secure transactions. Custom Crypto Exchange Development is pivotal in facilitating these transactions, offering tailored solutions for businesses to manage and trade digital assets securely.

Market Democratization: FinTech is making financial services more accessible to a broader audience, from businesses to individual investors. The democratization of financial tools empowers more people to manage their finances effectively. Platforms that offer micro-investing, peer-to-peer lending, and crowdfunding are breaking down barriers and allowing more individuals to participate in financial markets.

Products for Self-Employed: FinTech provides tools for freelancers and self-employed individuals to manage taxes, invoices, and financial stability. These applications support the growing gig economy by offering specialized financial solutions. Features like automated invoicing, expense tracking, and financial planning help self-employed individuals streamline their financial management and focus on growing their businesses.

Types of FinTech Apps

Digital Banking Apps: Allow users to manage bank accounts and financial services without visiting physical branches. These apps offer features like balance checks, fund transfers, and bill payments.

Payment Processing Apps: Enable seamless web and mobile transactions, enhancing customer convenience. These applications support various payment methods, including credit cards and digital wallets.

InsurTech Apps: Improve risk assessment and streamline the insurance application and claims process. These apps offer users faster ways to apply for coverage and manage claims.

Investment Apps: Democratize investing by reducing barriers and automating portfolio management. Investment apps provide real-time market data, trading platforms, and robo-advisors.

Personal Finance Management Apps: Help users track income, expenses, and manage their finances efficiently. These apps provide budgeting tools, track expenses, and assist with financial goal setting, making it simple to learn how to do an expense report and stay on top of your finances.

Tax Management Apps: Simplify tax preparation and filing through automated processes. These apps help users calculate taxes, file returns, and stay compliant with tax regulations. As cryptocurrencies become more integrated into financial transactions, businesses must stay informed about crypto taxes to ensure compliance and avoid potential legal issues.

Exchanges and Exchange Services: Facilitate currency exchanges and cryptocurrency trading. These platforms enable users to buy, sell, and trade digital currencies securely.

Benefits of FinTech Software Development for Businesses

Enhances Security: FinTech applications safeguard sensitive information through advanced encryption and biometric data, ensuring secure transactions. Security measures like two-factor authentication and blockchain further protect user data. Enhanced security protocols help build trust with customers, which is crucial for financial institutions.

Boosts Speed: Digital lenders can approve loans and transactions much faster than traditional methods, offering same-day funding. This speed improves customer satisfaction and operational efficiency. Faster processing times also reduce the risk of errors and fraud, as automated systems can quickly verify and validate transactions.

Robo Advisors: These provide customized investment strategies at a lower cost, making investing more accessible. Robo advisors use algorithms to offer personalized financial advice and portfolio management. By automating investment processes, robo advisors can offer lower fees compared to traditional financial advisors, making professional investment management more affordable for a wider audience.

Increases Efficiency: Automation in FinTech reduces the need for human intervention, enhancing efficiency and time management. Automated processes streamline operations and reduce errors, leading to cost savings. Efficient workflows and automated systems enable financial institutions to handle larger volumes of transactions and customers without compromising on service quality.

Improves Customer Experience: FinTech applications offer user-friendly interfaces and personalized experiences, improving customer satisfaction. Features like real-time notifications, intuitive navigation, and responsive customer support enhance the overall user experience. Personalization, driven by data analytics and AI, ensures that customers receive relevant and timely financial advice and services.

Expands Market Reach: FinTech solutions enable businesses to reach a global audience by offering digital financial services that can be accessed from anywhere. This expanded market reach opens up new revenue streams and opportunities for growth. By leveraging digital platforms, financial institutions can serve customers in remote and underserved areas, promoting financial inclusion

Features for FinTech Apps

Basic Features for FinTech Apps

Secure Signup: Ensures user data protection during the registration process. Implementing strong authentication methods, such as two-factor authentication and biometric verification, enhances security.

Voice Recognition: Adds an extra layer of security and convenience. Voice recognition technology can be used for secure login and transaction authentication, providing a seamless user experience.

Link Bank Accounts: Allows users to connect their bank accounts for seamless transactions. Integrating with banking APIs enables real-time access to account balances, transaction history, and transfer capabilities.

Instant Money Transfer: Enables quick and easy money transfers between accounts. Implementing secure and efficient payment gateways ensures fast and reliable fund transfers.

Push Notifications: Keeps users informed about account activities and updates. Push notifications can alert users to important events, such as low balances, transaction alerts, and promotional offers.

Investment Advice: Provides users with personalized investment recommendations. Utilizing AI and data analytics, investment apps can offer tailored advice based on users’ financial goals and risk tolerance.

Budget Organization: Helps users manage their finances and set budgeting goals. Budgeting tools can categorize expenses, track spending, and provide insights into saving opportunities.

Messaging Chatbot: Offers automated customer support and answers to user queries. AI-powered chatbots can handle routine inquiries, provide financial advice, and assist with account management.

Premium Features for FinTech Apps

AI Personalization: Uses AI to tailor the user experience based on individual preferences. AI algorithms can analyze user behavior and preferences to offer customized financial solutions and recommendations.

Data Analytics: Provides insights into financial data to help users make informed decisions. Advanced analytics can identify trends, predict future financial needs, and offer actionable insights.

Advanced Investment Advice: Offers sophisticated investment strategies and portfolio management. Premium investment features can include access to expert advisors, in-depth market analysis,

Robo Advisor: Automates investment management and provides personalized advice.

Easy Compatibility: Ensures the app works seamlessly across different devices and platforms.

Cross-Platform Functionality: Allows the app to run on multiple operating systems, enhancing accessibility.

Required Tech Stacks for FinTech App Development

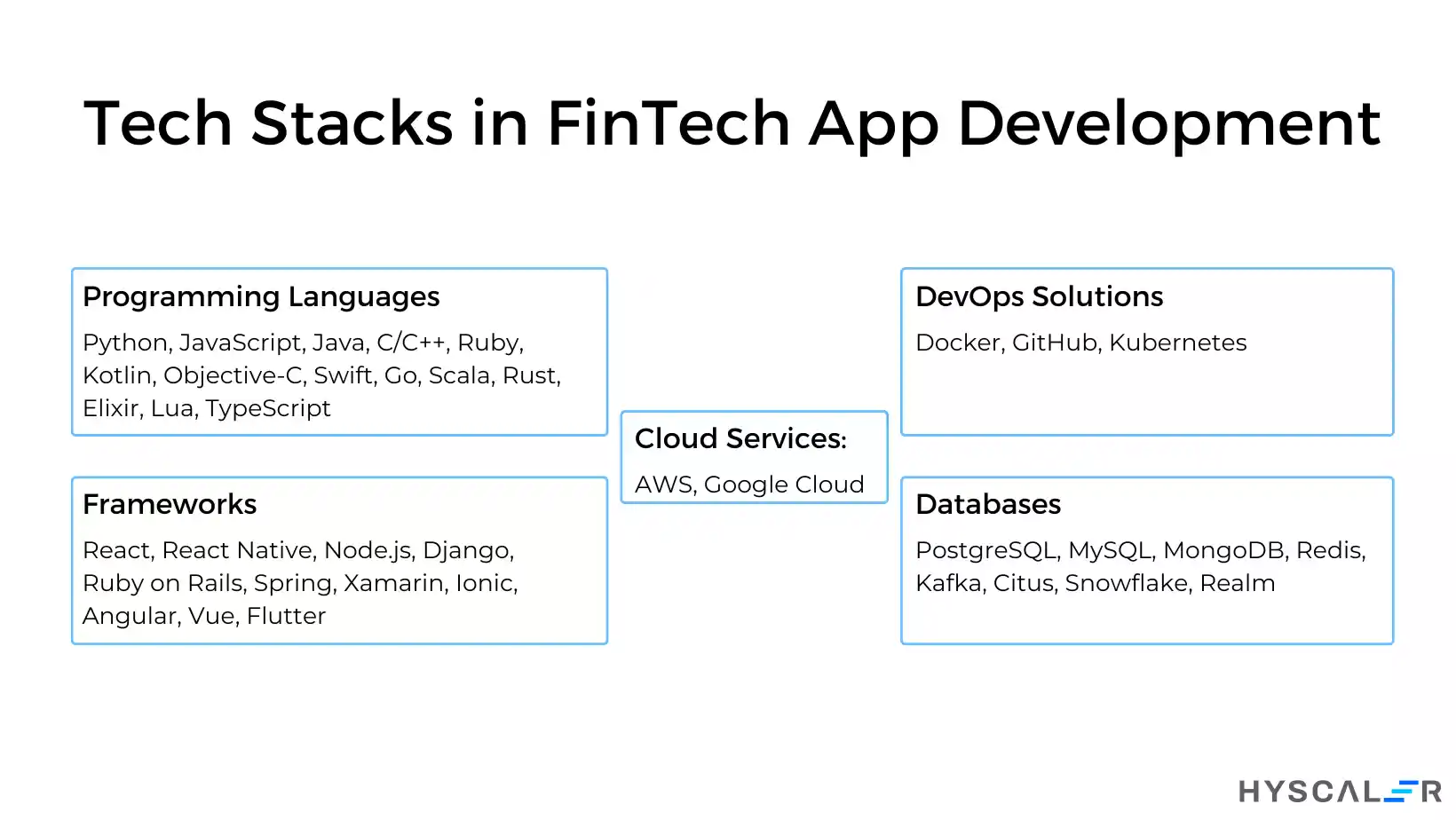

To develop a FinTech app, a robust tech stack is essential. Here are some of the key components:

Programming Languages: Python, JavaScript, Java, C/C++, Ruby, Kotlin, Objective-C, Swift, Go, Scala, Rust, Elixir, Lua, TypeScript

Frameworks: React, React Native, Node.js, Django, Ruby on Rails, Spring, Xamarin, Ionic, Angular, Vue, Flutter

Databases: PostgreSQL, MySQL, MongoDB, Redis, Kafka, Citus, Snowflake, Realm

Cloud Services: AWS, Google Cloud

DevOps Solutions: Docker, GitHub, Kubernetes

These tools and technologies provide the foundation for developing secure, scalable, and efficient FinTech applications.

How to Develop a FinTech App: App Development Process

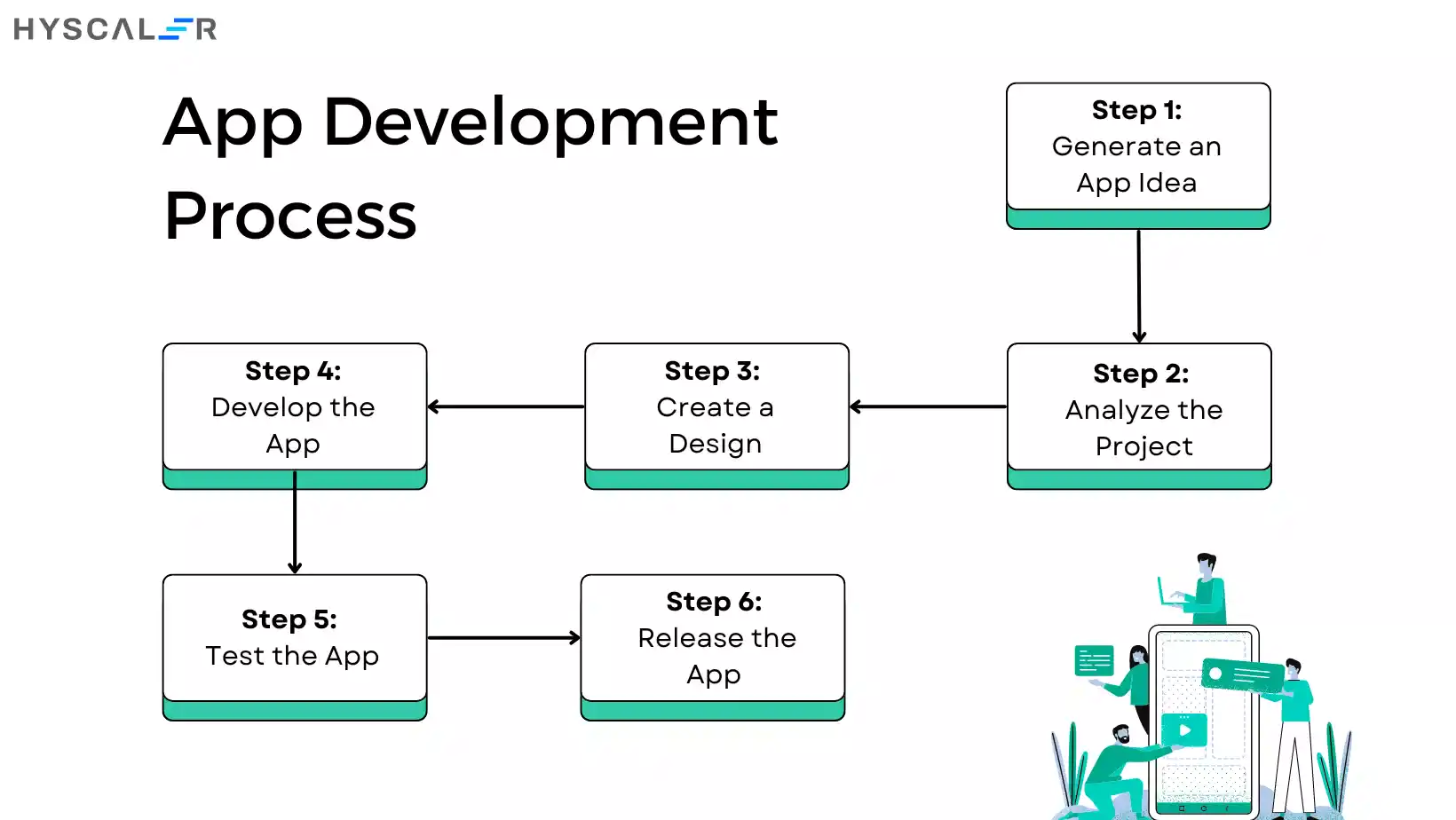

Creating a fintech application is a multi-step process that requires time, investment, and a clear strategy. Here’s a streamlined guide for fintech startups to develop a fintech app in six essential steps:

Step 1: Generate an App Idea

Start by brainstorming features that are essential for any fintech app, such as card linking and security measures. Identify a unique feature that will differentiate your app from competitors. To build a fintech app, you must highlight your Unique Selling Point (USP) to attract and retain users, as it will offer something they can’t find elsewhere.

Step 2: Analyze the Project

Conduct thorough market research to understand the type of application and the best monetization model for it. Evaluate the project, define your budget, and set realistic deadlines. This stage also involves analyzing your target audience. Identify a specific user group, such as new cryptocurrency investors or individuals wanting to track their finances. Conduct interviews with potential users to gain insights that will enhance your app’s features and usability.

Step 3: Create a Design

A user-friendly design is critical. Users appreciate simplicity, transparency, and aesthetic appeal. Begin with references and personal preferences, then collaborate with a UI/UX team to develop the design. Start with wireframes to outline the app’s logic and ensure that it’s intuitive for users. Once the wireframes are refined, create a comprehensive UI-kit containing all design elements like buttons, icons, and fonts. This kit simplifies the development process and facilitates the creation of new screens.

Step 4: Develop the App

Clearly define your project vision and the core features of your fintech app. Discuss these with your development team to ensure everyone is aligned. Consider starting with a Minimum Viable Product (MVP) — a basic version of your app that includes its main functionalities. An MVP allows you to test your concept in the market with minimal investment. If the app proves successful, you can scale it up; if not, you can pivot or abandon the project with minimal loss.

Step 5: Test the App

Thoroughly test the application to ensure it functions correctly. This includes verifying that it works across different devices and screen resolutions, especially if you plan to launch on both iOS and Android. Ensure that smaller screens do not compress the content excessively, making the app difficult to use. Rigorous testing helps you catch and fix bugs before the app goes live, ensuring a smooth user experience.

Step 6: Release the App and Collect Feedback

Launch your app on the App Store and Google Play Market. After the release, actively collect feedback from early users to identify any issues and areas for improvement. User feedback is invaluable for making necessary adjustments and updates to enhance the app’s functionality and user satisfaction.

Factors Determining App Development Cost

App Complexity: More complex apps require more development time and resources.

Design Requirements: Custom designs and user interfaces can increase costs.

Development Team and Location: Hiring developers from different regions can affect the budget.

Third-Party Integrations: Integrating external APIs and services can add to the cost.

Compliance and Security Standards: Meeting regulatory requirements and ensuring security can be expensive.

App Platform: Developing for multiple platforms (iOS, Android) increases costs.

Tech Stack: The choice of technologies can impact the development budget.

Quality Assurance: Thorough testing is essential and can add to the cost.

Maintenance: Ongoing support and updates are necessary to keep the app running smoothly.

Empower Your FinTech Vision with HyScaler

Developing a successful FinTech app requires a strategic approach, cutting-edge technology, and industry expertise. At HyScaler, our team of seasoned professionals is dedicated to helping you transform your innovative ideas into a powerful and secure FinTech solution. Whether you’re looking to streamline financial services, enhance user experience, or break new ground in the industry, we have the tools and knowledge to support your vision.

Ready to embark on your FinTech journey? Partner with HyScaler and leverage our expertise to create a robust, user-friendly, and compliant FinTech app that stands out in the competitive market. Contact us today and take the first step towards revolutionizing the financial technology landscape.