Table of Contents

The financial world is coming at a turning point. Traditional banking, long governed by powerhouses of centralised control, faces a ground-breaking shift into a breakthrough space. Here comes Decentralised Finance, a technological revolution powered by blockchain, and is democratising financial services and empowering people to such unprecedented levels.

From lending and borrowing to trading and wealth management, Decentralized Finance is cutting out the middleman, lowering costs, and increasing access. This revolution is not just for crypto enthusiasts; it is shaping the future of global finance and attracting businesses, investors, and policymakers alike.

Understanding Decentralized Finance (DeFi): A Paradigm Shift

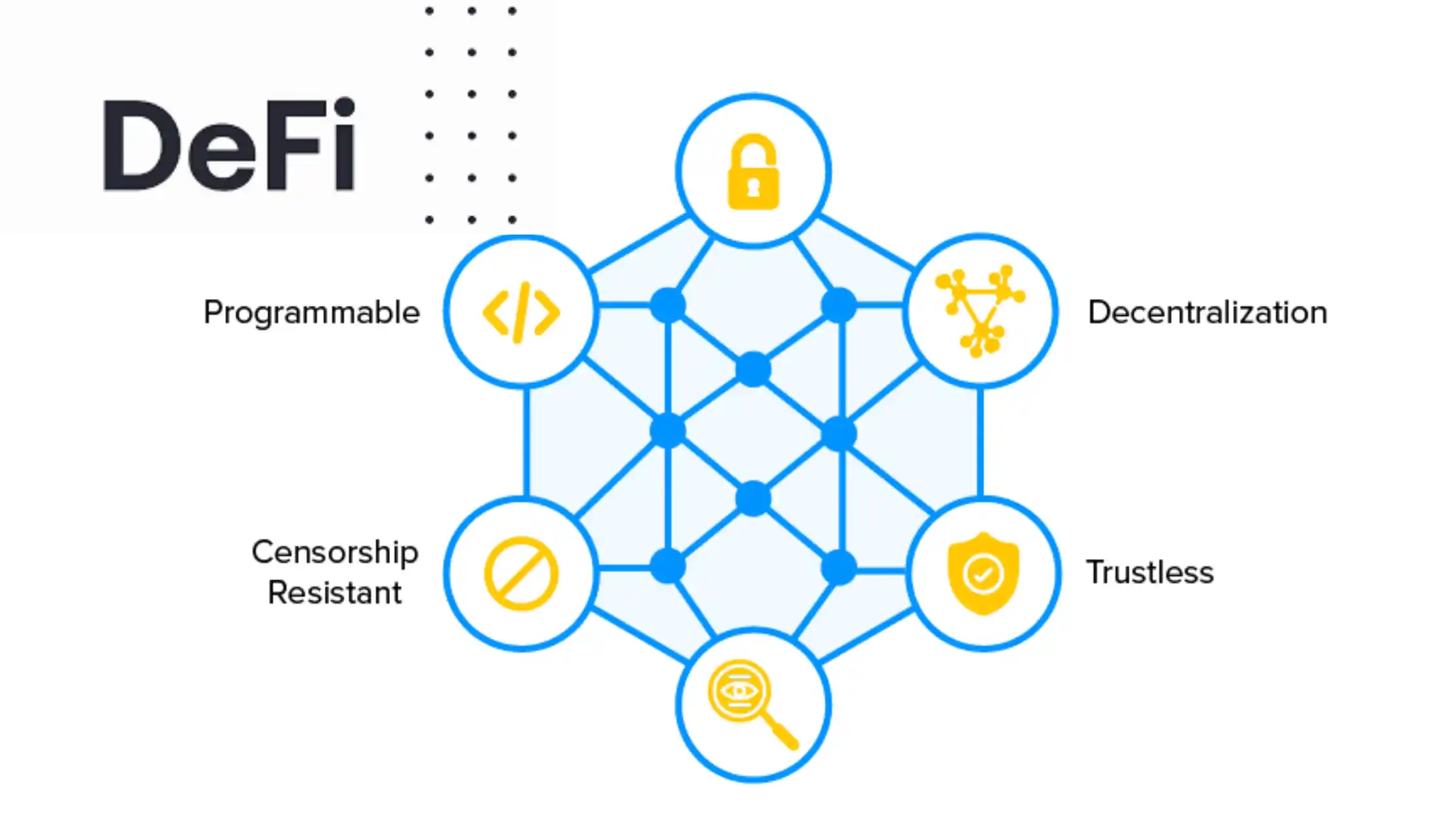

Decentralized Finance, or DeFi, is a blockchain-based financial system that is independent of traditional financial institutions. Unlike banks, which rely on intermediaries to facilitate transactions, Decentralized Finance uses smart contracts, which are self-executing agreements stored on blockchain networks. Such contracts enable trust less, automated financial transactions without third-party involvement. This type of DeFi smart contract development enables trustless, automated financial transactions without third-party involvement.

DeFi, or DApps (Decentralized Applications), is changing everything about financial services. Whether one talks about yield farming, staking, lending, or even decentralized exchanges (DEXs), the applications empower users to make decisions over assets while ensuring maximum transparency and security.

Why DeFi is the Future of Finance

1. Financial Inclusion: Bridging the Gap

One of the most powerful advantages of Decentralized Finance is that it allows millions of people who are currently without banks to access financial services. The barriers that traditional banking systems create include strict credit requirements, high fees, and limited accessibility. DeFi breaks these barriers since anybody with an internet connection and a digital wallet can enter the financial ecosystem.

2. Transparency and Security: A Trustless System

Banks are central, thus vulnerable to fraud, corruption, and general mismanagement. Conversely, DeFi platforms run on public blockchains, hence a transparent system, allowing every transaction to be verified. Every smart contract function is executed automatically without human interference, thereby naturally staying out of manipulation.

3. Maximizing Returns: Higher Yield Opportunities

Traditional savings accounts attract very low interest rates, hardly beating inflation at times. Decentralized Finance introduces fresh financial models in the form of liquidity pools, yield farming, and staking, where returns on assets can be earned substantially higher. Because there are no intermediaries involved, rewards directly go to users, and this makes wealth creation more accessible.

4. 24/7 Accessibility: No More Banking Hours

DeFi sites are available 24/7, unlike traditional banks, which may take fixed hours, and thus delay transactions. With the use of DeFi platforms, users can engage with them at any time to make a transfer, take out a loan, or earn interest on crypto assets.

How Decentralized Finance (DeFi) Works

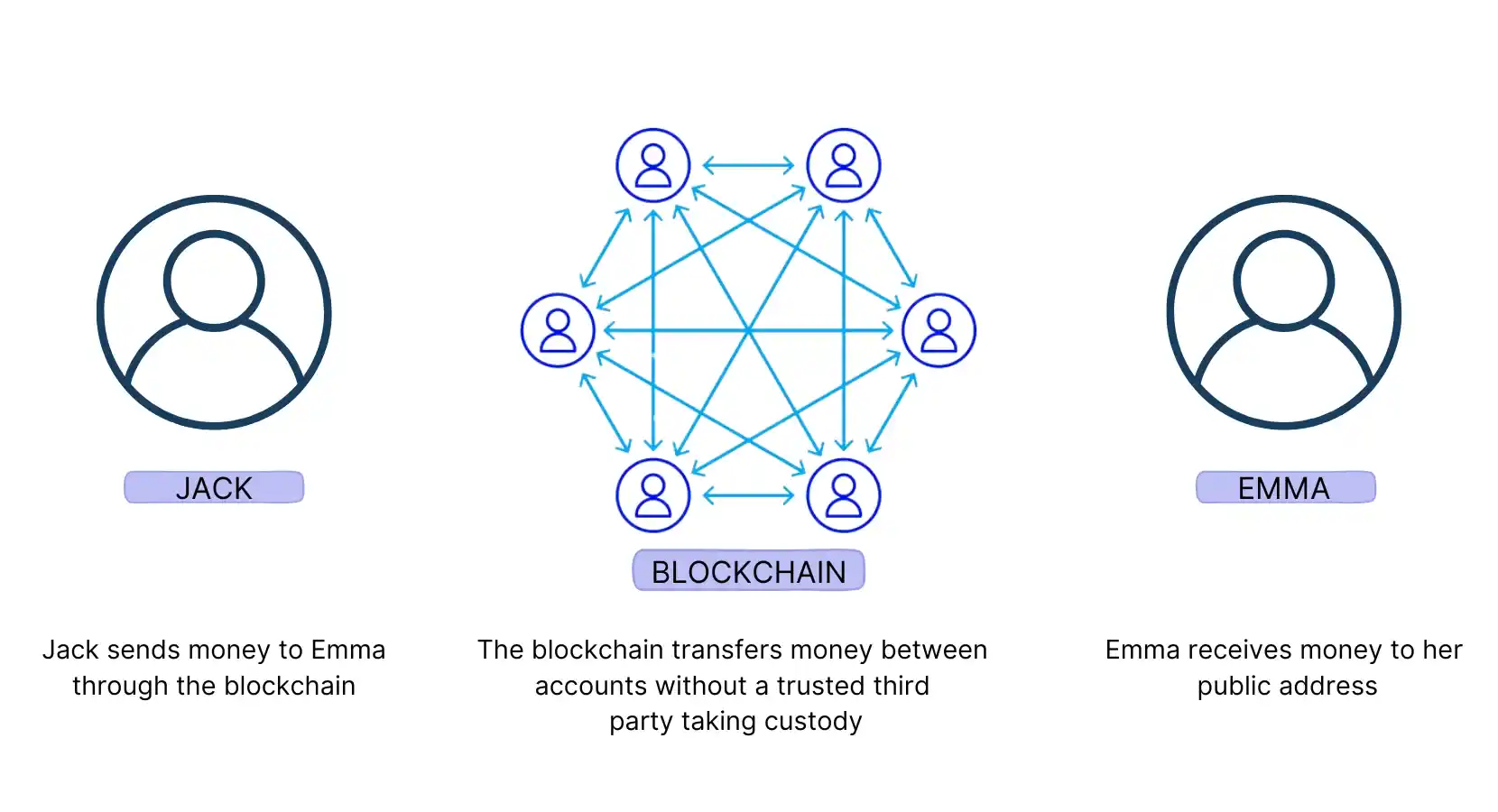

- DeFi works on peer-to-peer financial networks through security protocols, connectivity, software, and hardware development.

- It eliminates intermediaries such as banks and financial institutions, thereby reducing costs for businesses and customers.

Blockchain technology allows secure transactions, thus minimising the need for third-party oversight.

Blockchain in DeFi

- Blockchain is a distributed and secured ledger that records transactions in “blocks.”

- Transactions are verified through automated processes before a block is closed and encrypted.

- There is a link between each block, making it very secure and resistant to tampering.

- Private keys within the digital wallet give ownership of virtual tokens (cryptocurrency).

- Transactions are irreversible and transparent, which builds trust within the system.

DeFi Applications & Use Cases

- The DeFi apps talk to the blockchain, allowing users to perform financial transactions without the intervention of third parties.

- The application can be run on devices such as computers, tablets, or even mobile phones, pushing DeFi to more people.

- DeFi applications facilitate various financial activities, including:

- Lending & Borrowing – Users can lend cryptocurrency and receive interest or borrow from others under agreed terms.

- Payments & Transactions – Instant, border less, and peer-to-peer payments

- Trading & Investments – Decentralized exchanges, or DEXs, that enable users to trade digital assets without intermediaries.

- Smart Contracts – Automated contracts that execute if certain predefined conditions are met.

- Global Accessibility – Anyone can access the Decentralized Finance service from any place, bringing global financial inclusion.

The Challenges of DeFi Adoption

While Decentralized Finance offers immense potential, it is not without challenges. Here are some hurdles that must be addressed for widespread adoption:

1. Regulatory Uncertainty: The Compliance Conundrum

Decentralized Finance falls under a somewhat unregulated territory, and its practice has not escaped the radar of governments and financial regulators from across the world. While a few countries open their arms to DeFi, others are laying strict regulations for the protection of consumers and prohibition of illicit acts. The need to balance innovation with compliance would determine the future sustainability of DeFi.

2. Smart Contract Vulnerabilities: The Security Dilemma

Although blockchain is by nature secure, Decentralized Finance applications are still prone to hacks and vulnerabilities in smart contracts. Millions of dollars have been lost through exploits and security breaches. The developers are continuously working on making smart contracts more secure through audits, but investors need to be cautious and invest in well-established platforms.

3. User Experience: Overcoming Complexity

For a beginner, the Decentralized Finance landscape is overwhelming. There is a learning curve to understand crypto wallets, private keys, and liquidity protocols. However, as Decentralized Finance matures, user-friendly interfaces, educational resources, and customer support services are making it more accessible to a broader audience.

The Future of DeFi: A New Financial Ecosystem

The future of finance lies not in competition between traditional banks and Decentralized Finance but in their collaboration. Most major financial institutions, including JPMorgan, Citigroup, and Goldman Sachs, have already started experimenting with blockchain technology and decentralised applications. The integration of the elements of DeFi into traditional banking would open up the door to a financial ecosystem that is effective, transparent, and inclusive.

Institutional Adoption: A Sign of Maturity

The potential of Decentralized Finance is recognised by institutions, and we can see hybrid financial models that combine the best aspects of centralised and decentralized systems. We may see improvements in security measures, regulatory frameworks, and mainstream acceptance.

Mass Adoption Through Innovation

With advancements in layer-2 scaling solutions and cross-chain compatibility along with regulations, Decentralized Finance will remain accessible to everyday users and businesses. This will be a true financial revolution wherein people can have complete control over their assets rather than relying on traditional banks to handle all this.

Conclusion: Embracing the DeFi Revolution

Decentralized Finance, DeFi, has marked a new era in the financial world by increasing accessibility and reducing costs and maximizing returns, while improving security. Challenges exist, but with continuous innovation and regulatory evolution, DeFi is sure to stand as one of the pillars of modern finance.

Adapting and integrating DeFi solutions is going to be the game-changer for businesses and investors looking to stay ahead of the curve, since the future is decentralized, and embracing it today will lead to tomorrow’s financial revolution.