Table of Contents

Cloud computing in financial services is transforming how banks, insurance companies, and securities firms operate by offering the scalability, efficiency, and instant accessibility of information. However, concerning the sensitivity and confidentiality nature of financial data, high levels of security and compliance with authority rules, plus seamless communication tools worthy of communication between financial services, are needed. HyScaler provides bespoke IT services, cutting-edge security solutions, and next-gen cloud computing, formed uniquely for banking and financial institutions. With a desire to protect sensitive data and push customer satisfaction, HyScaler ensures that financial organizations remain ahead in a competitive landscape while staying fully compliant with regulations.

The pandemic has emphasized the need for businesses to move toward seamless, customer-first digital solutions that remove the need for physical trips to actual stores or banks. This goes for everything from grocery orders online to conducting banking operations the move to digital solutions is undeniable. Banks are realizing that, in 2030, how they conduct business will be poles apart from what it is now. Though slow traditionally to move toward the adoption of cloud technologies, these very banks will now have to take concerted steps in strategizing their ways to allow them the competitive edge as the inevitability of the digital shift looms large ahead.

Cloud Computing in Financial Services Drives Success: Key Benefits Uncovered

- Adaptable and Scalable Solutions

Cloud computing in financial services empowers institutions to adjust operations seamlessly to meet changing demands. This is critical in a sector where transaction volumes vary widely. For instance:

- Cloud platforms facilitate the swift rollout of new services, enabling businesses to capitalize on market trends and comply with regulatory updates efficiently.

- By 2023, over 60% of surveyed financial organizations had transitioned at least 25% of their workloads to the cloud—a trend that continues to accelerate.

- Cost Optimization

Cloud computing’s pay-as-you-go model removes the need for costly on-premises infrastructure, reducing upfront investments and converting fixed expenses into flexible, variable costs.

- Migrating to the cloud is projected to save Fortune 500 financial institutions $60–80 billion annually by 2030.

- The global finance cloud market, valued at $29.72 billion in 2023, is anticipated to grow at a compound annual growth rate (CAGR) of 20.32%, reaching $188.98 billion by 2033.

- Smarter Data Management and Analytics

Cloud computing streamlines data storage and facilitates advanced analytics, delivering valuable insights for informed decision-making:

- Financial institutions leverage cloud-based tools to analyze customer behavior, manage risks, and predict market trends.

- Big data analytics on cloud platforms drives more effective strategic planning and enhances overall operational performance.

- Robust Security and Regulatory Compliance

Protecting sensitive customer data is paramount in financial services:

- Cloud providers deploy advanced security measures such as encryption, access controls, and real-time threat detection to safeguard data.

- Integrated compliance features ensure adherence to global standards like GDPR and PCI DSS, simplifying regulatory requirements and reducing risks.

- Driving Innovation Forward

Cloud computing in financial services accelerates the creation of new financial products and services:

- Fintech companies, such as Ratio, utilize cloud platforms to power mobile banking, robo-advisors, blockchain-based solutions, and tailored customer experiences.

- By embracing cloud solutions, organizations modernize outdated systems, streamline operations, and advance digital transformation efforts, unlocking new opportunities for growth and efficiency.

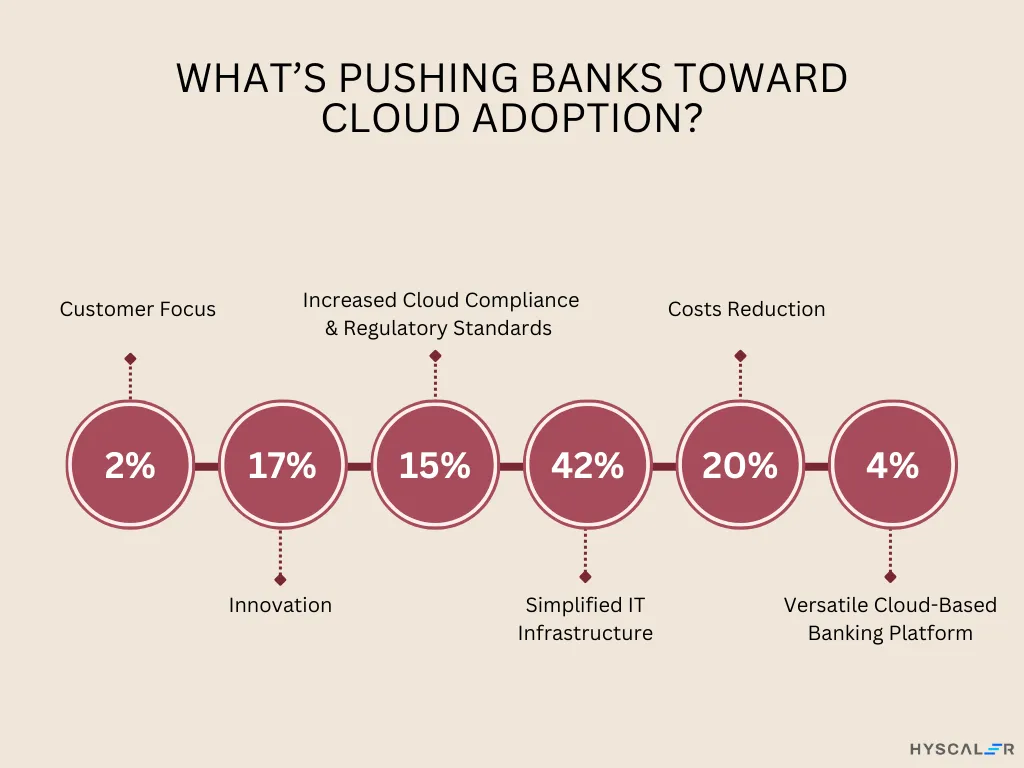

Adoption Trends in Financial Services: Embracing the Future of Finance

The rapid transition to cloud computing in financial services:

- By 2025, global spending on public cloud services is projected to surpass $805 billion, growing at a five-year compound annual growth rate (CAGR) of 19.4%.

- In 2022, 63% of financial institutions revealed plans to migrate their mainframe systems to public cloud platforms, underscoring the shift toward modernization and efficiency.

- North America leads the finance cloud market due to its robust infrastructure and focus on data security.

- Asia-Pacific is expected to witness exponential growth driven by rapid digitalization and fintech partnerships

Cloud Service Models

SaaS: This cloud type delivers web-based business applications for tasks like CRM, accounting, invoicing, and content management. It offers flexibility ease of use, and eliminates the need for extensive infrastructure.

PaaS: This infrastructure provides a comprehensive environment for developing, testing, and deploying applications and databases. It helps banks streamline development processes, reduce IT expenses, and minimize reliance on hardware and software infrastructure.

IaaS: Infrastructure as a Service (IaaS) allows banks to outsource resources like servers, data centers, and software, eliminating the need for in-house hardware investments.

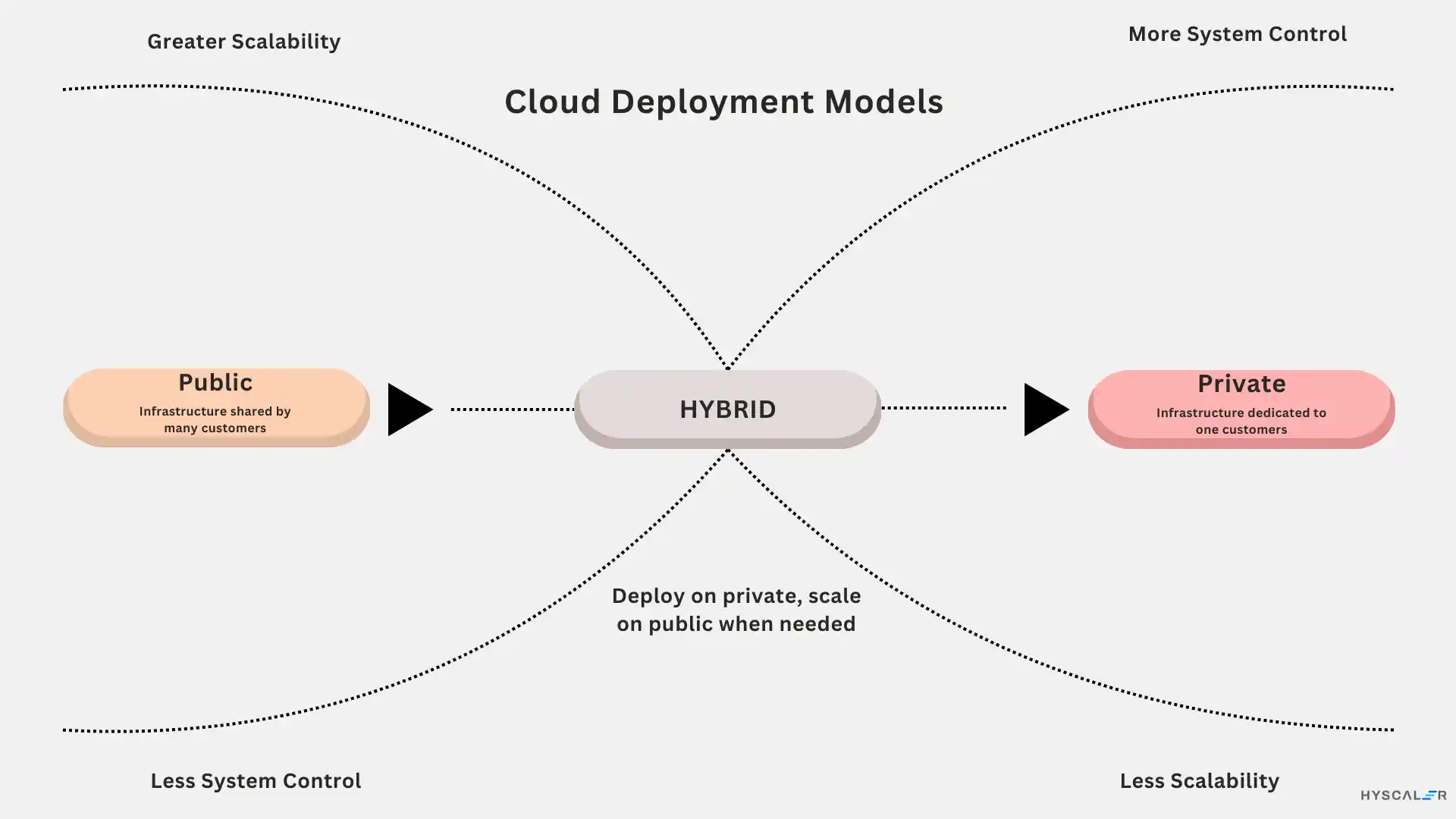

Cloud Deployment Models

Private Cloud: It is a dedicated cloud computing environment designed exclusively for a single banking or financial institution. Ideal for banks that prioritize data security, regulatory compliance, and customized solutions over the shared cost savings of public cloud alternatives.

Public Cloud: This infrastructure is open for the entire banking industry to share and is owned by organizations that sell cloud services. Banks can opt for this type if they are looking for economies of scale.

Hybrid Cloud: This infrastructure is composed of both private and public clouds that operate for their individual business use case.

Future of Finance: How Cloud Computing Transforms Banking and Financial Services

Financial institutions can achieve their business goals by leveraging cloud computing to acquire:

- Digital Banking Platforms

Cloud computing in financial services is empowering customers by providing a complete suite of digital banking services, such as mobile apps and Internet banking platforms. Cloud computing gives banks the potential to provide consumers with easy account access, individualized financial advice, real-time transaction updates, and features such as online payments and virtual wallets.

- Loan Origination and Processing

Cloud-based solutions streamline loan application processes by automating workflows and enabling cross-departmental collaboration, leading to faster decision-making. Similar efficiency gains are being realized in healthcare administration, particularly through cloud-supported services like Dental Insurance Credentialing, which streamline provider onboarding and compliance processes. These platforms easily integrate with outside services (e.g., credit score and income verification services) to expedite borrower valuations. This integration enables lenders to process an increased volume at a higher accuracy and speed, thereby greatly enhancing operational efficiency as well as customer satisfaction.

- Fraud Detection

Cloud adoption in banking is vital in handling vast amounts of data from various resources to analyze transactions and identify suspicious activities. It helps banks detect fraud before any harm is done.

- Data Analysis

Cloud computing in financial services allows using complex data analysis to extract insights for financial trends analysis, user behavior analysis, product interaction analysis, and others. Banks, financial, and insurance companies can use these insights to design products and services to meet customer needs and expectations, expanding the scope of their customer base.

- Customer Relationship Management (CRM)

Financial and insurance organizations are able to use cloud-based CRM systems to archive and maintain customer information and interactions in one place. Cloud computing in financial services sector allows companies to derive lucrative insights from such data and deliver customized services and products to their customers.

- Operational Synchronization

With data exchange and collaboration tools made available by cloud computing in financial services, integrating different business departments faster and more efficiently can be done, and operational synchronization can be achieved.

Conclusion: Embrace Cloud Computing in Financial Services

The global finance cloud market is projected to grow by a really strong 20.32% compound annual growth through the forecasted period, covering from $29.72 billion in 2023 to $188.98 billion in 2033. This is indeed the time to go and act. Join the select few who leverage cloud computing in financial services to unlock $60-80 billion annual headroom for such Fortune 500 companies by 2030. To give up on the chase is just foolish. Embrace the clouds now in innovating, enhancing operational performance, and securing a strong competitive edge from within this new digital landscape in finance!