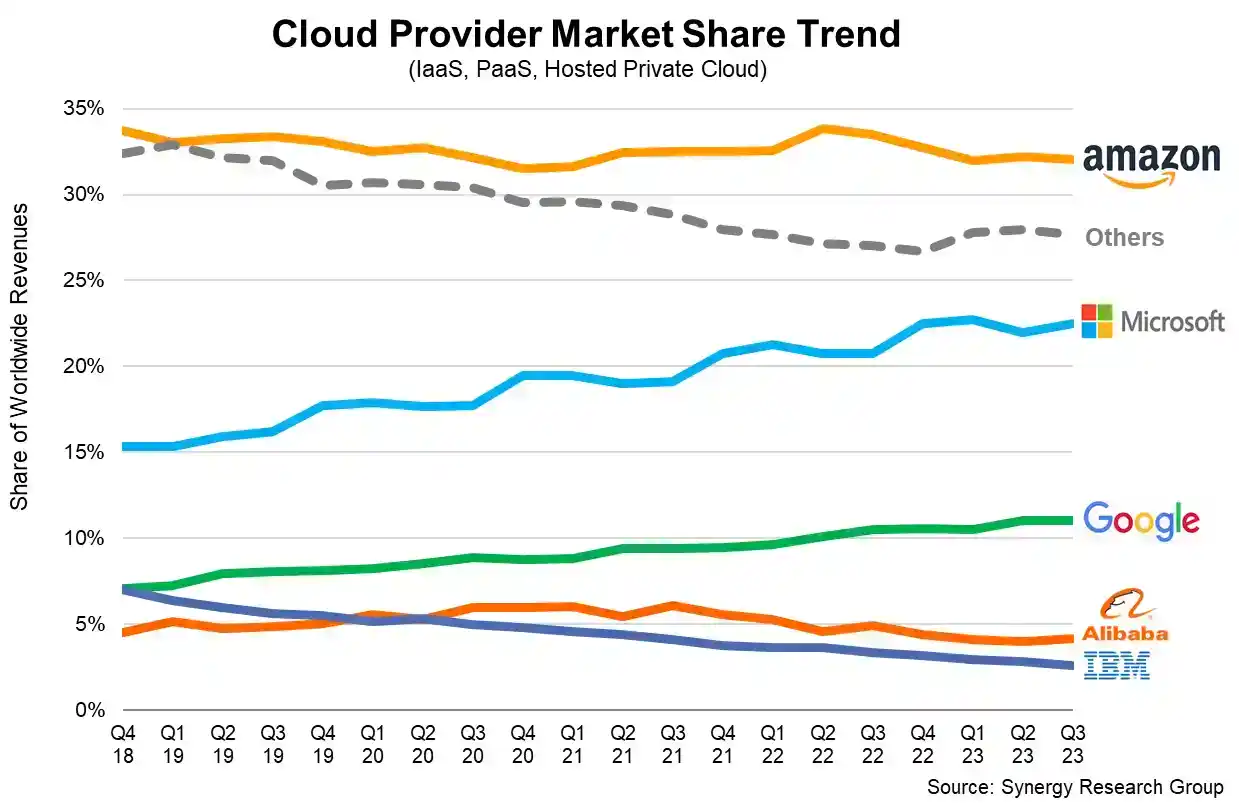

AI is more than just a buzzword; AI boosts cloud revenue for the leading cloud providers. According to Synergy Research Group, a firm that tracks IT and cloud markets, global spending on cloud infrastructure services reached $68 billion in the third quarter of 2023, up 18% from the same period last year.

The report also highlighted the role of generative AI technology and services in driving cloud demand, despite the challenging economic and political environment.

Table of Contents

AI boosts cloud revenue growth

Generative AI is a branch of artificial intelligence that can create new content or data, such as images, text, audio, or code, based on existing data or models. It has applications in various domains, such as entertainment, education, healthcare, e-commerce, and more.

The big three cloud providers – Amazon, Microsoft, and Google – have been investing heavily in generative AI research and development, as well as offering generative AI products and services to their customers. These include chips, platforms, tools, and frameworks that enable users to train, deploy, and run generative AI models on the cloud.

According to Business Insider, generative AI is still in its early stages, and its impact on cloud revenue is modest compared to other factors. However, the potential is huge, as generative AI can create new use cases and demand for other cloud services, such as storage and computing.

Amazon leads the pack with AWS

Amazon Web Services (AWS) is the dominant player in the cloud market, with a 32% share in the third quarter of 2023, according to Synergy Research. AWS reported a 12% increase in revenue to $23.1 billion, and a 62% share of Amazon’s total operating income.

AWS offers a range of generative AI products and services, such as:

- Chips: AWS has developed custom chips for both training and inference of generative AI models. These include Inferentia, which can run multiple types of generative AI models at high speed and low cost; and Trainium, which can train complex generative AI models at scale.

- Platforms: AWS has launched Bedrock, a service that allows users to run multiple generative AI foundation models on the cloud. These models can generate high-quality content or data across different domains, such as text, image, audio, or video.

- Tools: AWS has introduced CodeWhisperer, a tool that can generate code based on natural language input or existing code snippets. CodeWhisperer is powered by generative AI models and can help developers write faster and better code. CodeWhisperer is a competitor to Github’s Copilot, which is owned by Microsoft.

On its earnings call, AWS CEO Andy Jassy said he expects generative AI to be “a very substantial, gigantic new generative AI opportunity” for AWS in the next few years. He also said he believes AWS has an edge over its rivals in terms of the growth and quality of its generative AI business.

Microsoft follows with Azure

Microsoft Azure is the second-largest cloud provider, with a 23% market share in the third quarter of 2023. Azure reported a 29% increase in revenue, of which 3 points came from generative AI. This exceeded Microsoft’s own forecast of 2 points from generative AI.

Azure offers several generative AI products and services, such as:

- Chips: Azure has partnered with Nvidia to offer its customers access to Nvidia’s A100 Tensor Core GPUs, which are designed for training and inference of large-scale generative AI models.

- Platforms: Azure has launched Azure Synapse Analytics, a service that integrates data warehousing and big data analytics. Synapse Analytics enables users to run generative AI models on massive amounts of data and generate insights or predictions.

- Tools: Azure has developed Azure Machine Learning Studio, a tool that allows users to build, train, and deploy generative AI models using a drag-and-drop interface. Machine Learning Studio supports various types of generative AI models, such as text generation, image generation, or style transfer.

On its earnings call, Microsoft CEO Satya Nadella said he sees customers initiating new projects that are driven entirely by generative AI. He also said that generative AI projects are not only about generative AI meters; they also consume other cloud meters, such as storage and computing.

Analysts at Bernstein said Microsoft has taken the AI mantle from Google and that Azure could become a bigger and more important hyperscale provider than AWS.

Google lags behind with Google Cloud

Google Cloud is the third-largest cloud provider, with an 11% market share in the third quarter of 2023. Google Cloud reported a 22% increase in revenue to $8.4 billion, and a positive operating income of $266 million, compared with a loss of $440 million in the same quarter last year.

Google Cloud offers various generative AI products and services, such as:

- Chips: Google Cloud has developed its own chips for generative AI, such as the Tensor Processing Units (TPUs), which are specialized for training and inference of large-scale generative AI models.

- Platforms: Google Cloud has launched Vertex AI, a service that simplifies the development and deployment of generative AI models on the cloud. Vertex AI supports various types of generative AI models, such as natural language generation, image synthesis, or music generation.

- Tools: Google Cloud has created AutoML, a tool that automates the process of building and optimizing generative AI models. AutoML can generate custom generative AI models based on the user’s data and requirements.

On its earnings call, Google CEO Sundar Pichai said more than half of all funded generative AI startups are Google Cloud customers. He also said Google Cloud is investing in generative AI research and innovation, such as GPT-3, a large-scale language model that can generate coherent text on any topic.

However, investors were not impressed by Google Cloud’s performance, as it missed Wall Street estimates of $8.62 billion and posted its slowest quarterly growth since at least the first quarter of 2021.

Conclusion

AI is becoming a key driver of cloud revenue growth for the big three providers. They are leveraging artificial intelligence to create new products and services that can generate new content or data, such as images, text, audio, or code.

They are also competing with each other to offer the best chips, platforms, and tools for generative AI on the cloud. However, generative AI is still in its infancy, and there is a lot of room for improvement and innovation.