Table of Contents

Background

A mid-sized Non-QM (Non-Qualified Mortgage) lender processing 150+ loans monthly operates within the $12T+ mortgage industry. Competing with 100+ Non-QM lenders offering complex loan programs, the company faced inefficiencies in loan origination, compliance risks, and slow customer response times. Loan officers relied on outdated PDFs for program guidelines, hindering accurate borrower matching and creating operational bottlenecks.

The lender sought a scalable AWS digital lending platform to modernize operations through cloud-based loan management software that centralizes loan program intelligence, automates qualification extraction, and enhances customer experience.

Target Customer Profiles

Non-QM Lenders:

- Example: Mid-sized mortgage firms managing diverse loan programs

- Needs:Automated loan qualification, faster loan processing, CFPB compliance

- Persona: Operations Manager at a regional lender adopting AWS

Fintech Startups:

- Example: Digital lending platforms offering alternative financing

- Needs: Scalable lending management system, real-time analytics, SOC 2 compliance

- Persona: CTO at a fintech with AWS accounts

Credit Unions:

- Example: Community-based organizations expanding loan portfolios

- Needs: Cost-efficient loan processing automation, legacy system integration, enhanced borrower experience

- Persona: IT Director at a credit union seeking AWS lending software development

Challenge

The lender faced critical obstacles in its legacy loan origination system:

- Knowledge Fragmentation: Over 50 loan qualifiers (DTI, LTV, credit scores) across 200+ programs were scattered in PDFs, relying on tribal knowledge.

- Manual Inefficiencies: Loan officers spent 65% of their time extracting guidelines, delaying approvals, and increasing errors in the lending management system.

- Scalability Constraints: On-premises systems couldn’t handle growing loan volumes or frequent program updates, limiting market expansion.

- Compliance Risks: Manual processes lacked audit trails, risking non-compliance with CFPB and data privacy regulations.

- Poor Collaboration: Siloed communication between loan officers, underwriters, and borrowers slowed decision-making and degraded customer experience.

- Data Accessibility: Inefficient search across program documents hampered real-time borrower matching.

The company needed an automated lending platform to streamline workflows, ensure compliance, and scale operations effectively.

Solution

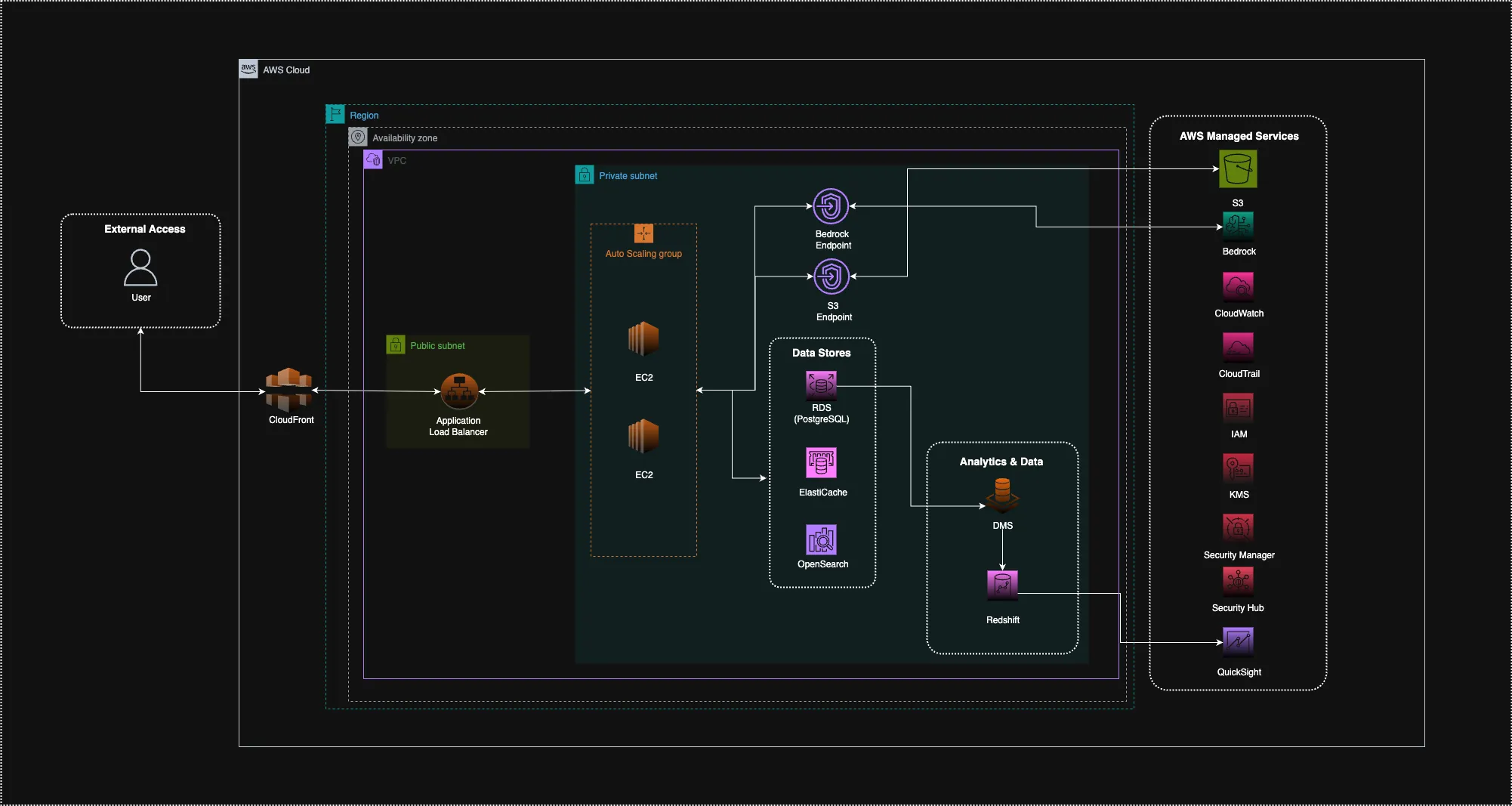

Partnering with HyScaler, the lender deployed an AWS digital lending platform powered by advanced AWS services:

- AI-Driven Knowledge Base: Using AWS Bedrock and multiple LLMs (Claude, Llama), the platform extracted 50+ qualifiers from lender documents with 95% accuracy, validated through human-in-the-loop workflows.

- Scalable Infrastructure: Built on Amazon EC2 instances for 99.9% uptime, Amazon RDS (PostgreSQL) with AES-256 encryption for secure data, and Amazon S3 for document storage.

- Message Queuing: Amazon SQS enabled asynchronous processing of program updates and borrower data, integrating seamlessly with legacy CRM systems.

- Search Optimization: Amazon OpenSearch Service delivered sub-second searches across loan programs, enhancing borrower matching.

- Caching Strategy: Amazon ElastiCache (Redis OSS) reduced database load by 60%, improving application performance.

- Analytics Dashboard: Amazon RedShift and QuickSight provided real-time insights into loan processing, compliance, and performance metrics.

- Collaboration Hub: LendConnect, a Slack-like tool, fostered communication among loan officers and included a lender rating system for community-driven insights.

- CI/CD Pipeline: GitLab CI and Amazon ECR automated code testing and deployment to EC2, ensuring rapid updates.

- Borrower Portal: A web and mobile app with US-specific formatting (MM-DD-YYYY) and e-payment support improved borrower engagement.

This digital lending automation AWS solution created a scalable, secure, and intelligent loan management software.

Why AWS & HyScaler

AWS was selected for its robust AWS financial services cloud solutions, offering scalability, SOC 2 compliance, and AI/ML capabilities via Bedrock. Services like EC2, SQS, OpenSearch, and ElastiCache ensured high availability and performance.

HyScaler’s expertise in AWS lending software development and Non-QM lending delivered a tailored automated lending platform. With 5+ years of AWS deployments and 10+ fintech projects, HyScaler ensured rapid implementation.

The cloud architecture and pay-as-you-go model reduced costs by 40% compared to on-premises solutions. HyScaler’s CI/CD pipelines, legacy integration via SQS, and regional optimizations (US-specific compliance) drove operational excellence and borrower satisfaction.

Customer Engagement Process

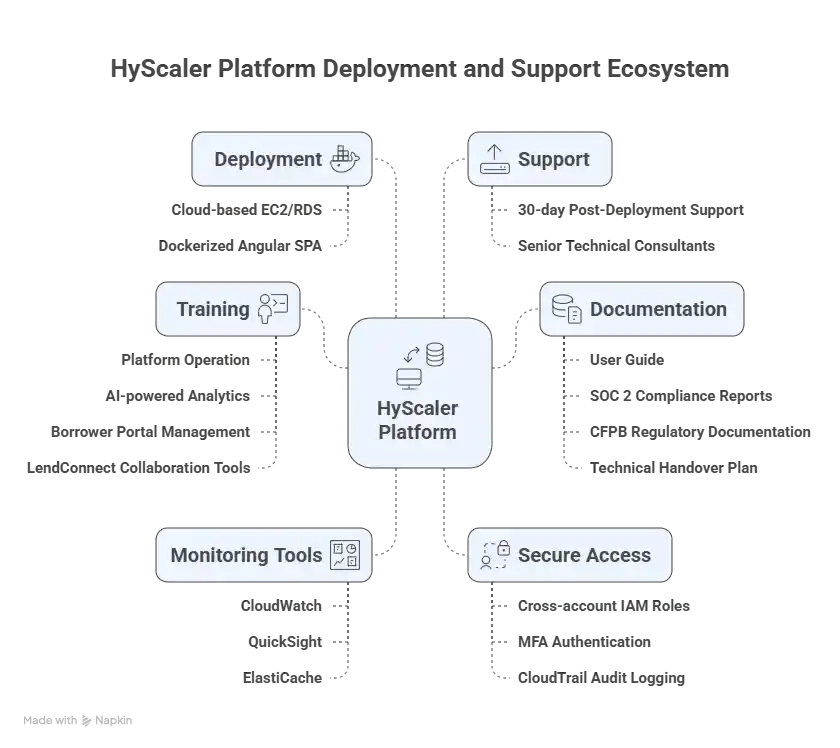

Structured 12-week engagement (Scope-Define-Implement-Deliver-Conclude).

- Scope (Weeks 1-2): Defined workflows, compliance needs, and AWS infrastructure via stakeholder workshops.

- Define (Weeks 3-4): Designed EC2 architecture, RDS schema, and CFPB compliance plan; secured approval.

- Implement (Weeks 5-8): Deployed Dockerized Angular app on EC2, configured RDS/SQS, tested for 99.9% uptime.

- Deliver (Weeks 9-10): Conducted UAT, trained staff on the platform, and provided compliance documentation.

- Conclude (Weeks 11-12): Handed over to IT with 30-day support; collected feedback via closure meeting.

- Post-Handover: Quarterly reviews to assess impacts (50% cost reduction, 95% accuracy improvement).

Delivery Mechanisms:

Team Expertise:

- Technical Consultants: Deep expertise in EC2, RDS, Bedrock AI services, and SOC 2 compliance frameworks.

- Full Stack Developers: Fintech-certified specialists skilled in Angular, AI/ML integration, and Non-QM lending domain knowledge.

- Project Managers: Coordinated engagement phases, stakeholder feedback, and risk mitigation with proven on-time delivery.

Technical Capabilities and Experience:

- AWS Expertise: 5+ years deploying AWS financial services solutions; 10+ lending platform projects using EC2, RDS, Bedrock, and SQS.

- Application Proficiency: 3+ years developing Angular-based lending management systems, with demonstrated efficiency improvements.

- Compliance Track Record: Successful delivery of SOC 2 and CFPB compliance audits for lending clients, validated through Security Hub and CloudTrail.

- Customer Success: Successfully deployed lending platforms for 12+ financial industries and Non-QM lenders, maintaining high customer satisfaction

- Certifications: Team holds 15+ AWS certifications, including Solutions Architect, AI/ML Specialty, and Financial Services competency validations.

Results

The AWS digital lending platform delivered transformative outcomes:

- Efficiency Gains: Reduced program onboarding time drastically, freeing loan officers to focus more on client engagement.

- Accuracy: Achieved highly reliable qualifier extraction, lowering compliance risks significantly.

- Search Performance: Sub-second program searches via OpenSearch improved borrower matching and decision speed.

- Application Speed: ElastiCache accelerated system responsiveness, enhancing the borrower and officer experience.

- Cost Savings: Shift to AWS cloud infrastructure lowered operational costs substantially.

- Scalability:Seamlessly supported growing loan volumes and frequent program updates without extra infrastructure investment.

- Customer Satisfaction: Borrower portal adoption grew considerably, reducing inquiries and improving overall satisfaction.

- Collaboration: LendConnect enhanced team productivity through streamlined real-time communication.

- Compliance: Achieved full SOC 2 compliance with CloudTrail audit logs.

- System Reliability: Optimized caching reduced database loads, strengthening performance stability.

Conclusion

The AWS-powered lending platform, deployed by HyScaler, revolutionized the lender’s operations, leveraging EC2, Bedrock, SQS, OpenSearch, and ElastiCache. This cloud-based loan management software delivered unmatched efficiency, compliance, and scalability, positioning the company as a Non-QM market leader.

The AI-driven intelligence, optimized search, and LendConnect hub set a new standard for lending software for banks. As the lending industry evolves, AWS financial services cloud solutions and digital lending automation AWS offer a blueprint for transformation.

The lender plans to expand the platform to support new loan types, reinforcing its competitive edge. Other organizations can adopt AWS lending software development to drive innovation and customer value.